【Hong Kong】Prepare IR56B for submission

26-Jul-2024 · Felix Fung

Available in other languages 中文

Available in other languages 中文

What do we need?

Let's make sure the following are done before we move onto IR56B reporting:

- Tax information of employer is updated (Master Data --> Organization)

- Employees' personal infomation is updated (Staff --> Applicant)

- Payrolls from last April to March are done and posted (Payroll --> Payroll Batch)

- Pay types are correctly configured on whether it is taxable with proper tax category (Master Data --> Job Order Template)

➡️ Details setting can take a look at Get Ready for using Taxation

Steps to preparing IR56B for submission

1. Preparing IR56B Batch

- Go to Taxation --> IR56B

- Click "Add New"

- Specify the company and tax period

- Confirm. You now have a blank IR56B batch

- Click "Add Placement"

- Pick who you are reporting tax. Just like payroll.

- Confirm. The staff are being added to the IR56B batch.

2. Reviewing IR56B

- Check and make changes to individual tax forms one by one, or

- Generate the reports to check the amount

- Go to Analytic->Taxation->

- Tax Details Report,

- Tax Summary Report, or

- Go to Analytic->Payroll->Payroll Details by Placement

- remember to choose the date of the tax period

➡️ Take a look at How to handle the "-ve" in tax form? if you find there "-ve" after generating the tax form.

- remember to choose the date of the tax period

- Go to Analytic->Taxation->

3. Submitting IR56B via * etax Mixed Mode

In 2019, IRD has updated the IR56B format and the employer can submit IR56B via e-tax. But you need to get the IRD approval before. Take a look at Obtain approval from IRD on preparing IR56 forms by using Employer's Self-developed Software if you do not get the approval from IRD

-

In IR56B batch, go to More->Generate IR56B for eTax

- Save the XML file

- Make sure you can see the line <IR56VER>B0001</IR56VER> in the file.

-

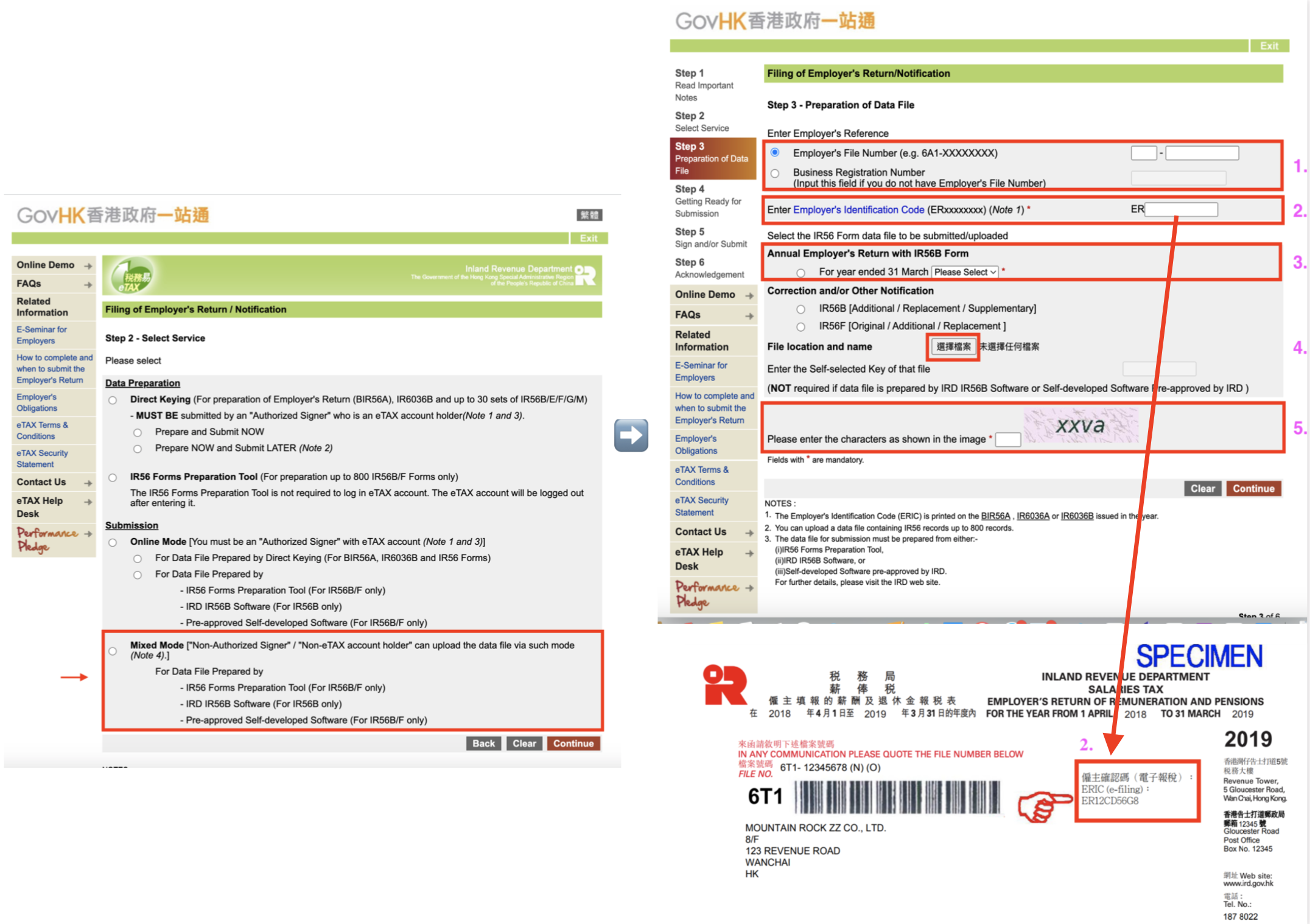

Go to GovHK website upload the XML file :https://www.gov.hk/en/residents/taxes/etax/services/efiling_er.htm

- Submit IR56 via etax Mixed Mode

- Choose Mixed Mode and input the information needed(Tax file number, Employer Identification Code)

- Check and Submit the information

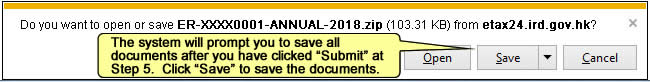

- Save and Print the Acknowledgement and the Control List

- Sign and Submit the Control List with a duly completed and signed paper BIR56A

⚠️ The Authorized Signer is required to sign on each and every page of the Control List

- Submit IR56 via etax Mixed Mode

-

You can refer to the below websites for the procedures

1. Online Demo

2. User Guide in PDF (P.30)

4. Delivering IR56B to your staffs

- If you have ESS module, once your IR56B batch is posted, your staffs will see it available for download in ESS.

- Alternatively, you can Print or Email the forms to staffs

In this page