Obtain approval from IRD on preparing IR56 forms by using Employer's Self-developed Software

Available in other languages 中文

Starting from tax year 2022/2023, each company submitting IR56 forms via eTAX must seek prior approval from the Inland Revenue Department. We will help you to get the approval.

How can we help to get approval for your company?

IRD already approved IR56 forms generated by Backstage. What we need to do is to tell IRD you are our clients and IRD will extend the approval to cover your company.

In latest version of Backstage, it will contact our approval database and check the approval status of each of your company. If you company is not present in the database, you can submit the information in Backstage and we will process the approval. Once IRD reply, we will update the approval database and you will know the latest status.

Check your approval status

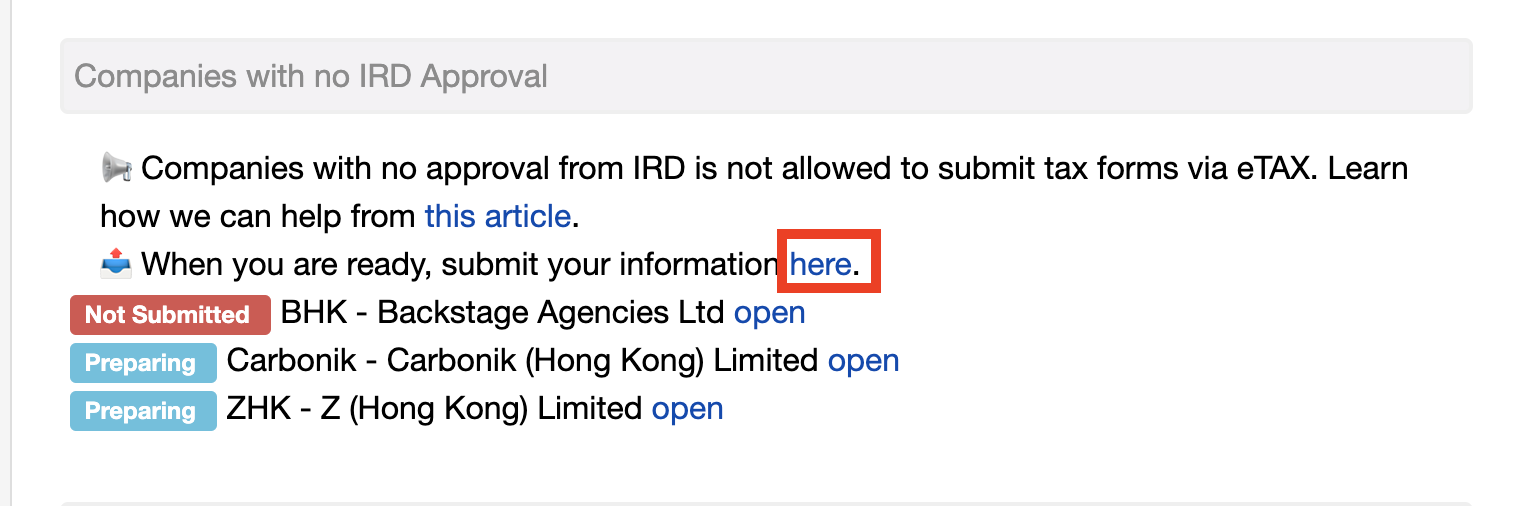

A new Dashboard reminder will show up if you have permission to view Organization records. For each company, Backstage will tell you the status and action required.

The different statuses are:

- Missing Tax File Number tax file number is not provided. Fill in the correct tax file number for Backstage to begin the approval process.

- If you want to exclude this company from IR56 forms submission, put "-" at Tax File Number and Backstage will stop reminding you

- Not Submitted we are unable to receive your information (Backstage behind a firewall?). Send us your company name and tax file number for manual handling

- Pending your approval request is submitted to IRD

- Approved approval is obtained for this company

Submit your IRD Approval request

- When qualified company is found, a link to the submission form will be available in the Dashboard reminder. Click "here" and open the submission page

- Confirm the information going to send us

- Click "Submit"