Overview

Available in other languages 中文

Backstage Taxation module enables you to prepare tax form IR56E, IR56B, IR56F, IR56G, and IR56M to staffs, and also make use of these result in Taxation modules. The key records in this module are:

- IR56E: For Commencement of Employment

- IR56B: For Employees Still Under Employment as at 31 March

- IR56F Batch: For Cessation of Employment

- IR56G: For Employee who ceased Employment and is about to leave Hong Kong

- IR56M: For Persons Other Than Employees, e.g consultants or agents who remuneration is in excess of $25,000, or sub-contractors who remuneration is in excess of $200,000 for the year before 30 March. Please disable "Require Tax Filing?" in the staff placement profile.

Get Ready for using Taxation module

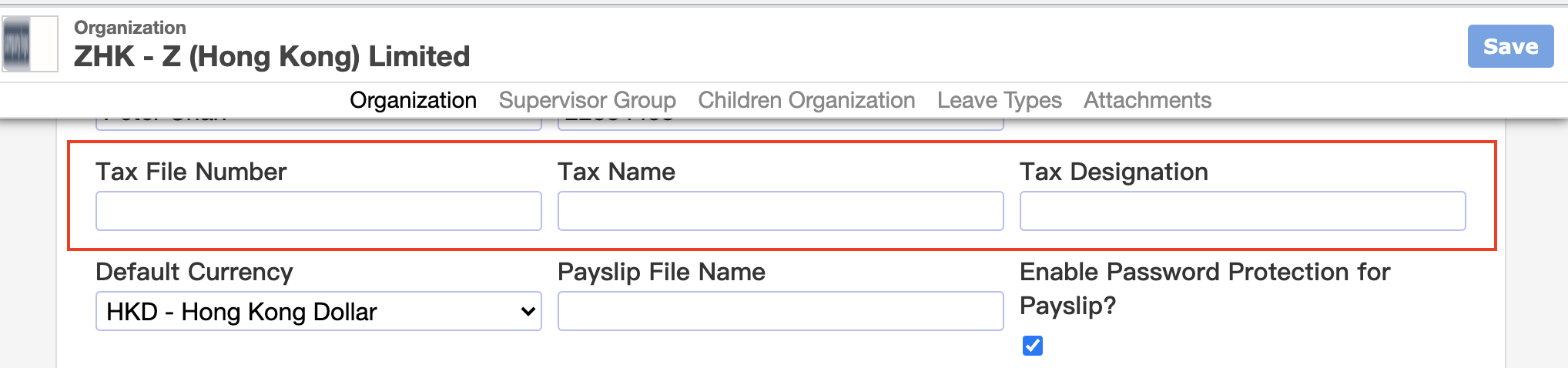

1. Fill in/Update Company Tax information

Backstage has to know the Company Tax information before generating the tax form

- Go to Master Data->Organization->Parent Organization(with "TOP" beside)

- Input the Tax File Number(e.g 6G1-12345678), Tax Name(the person who sign the tax form), Tax Designation(Title of the person)

- Please confirm the information is up-to-date

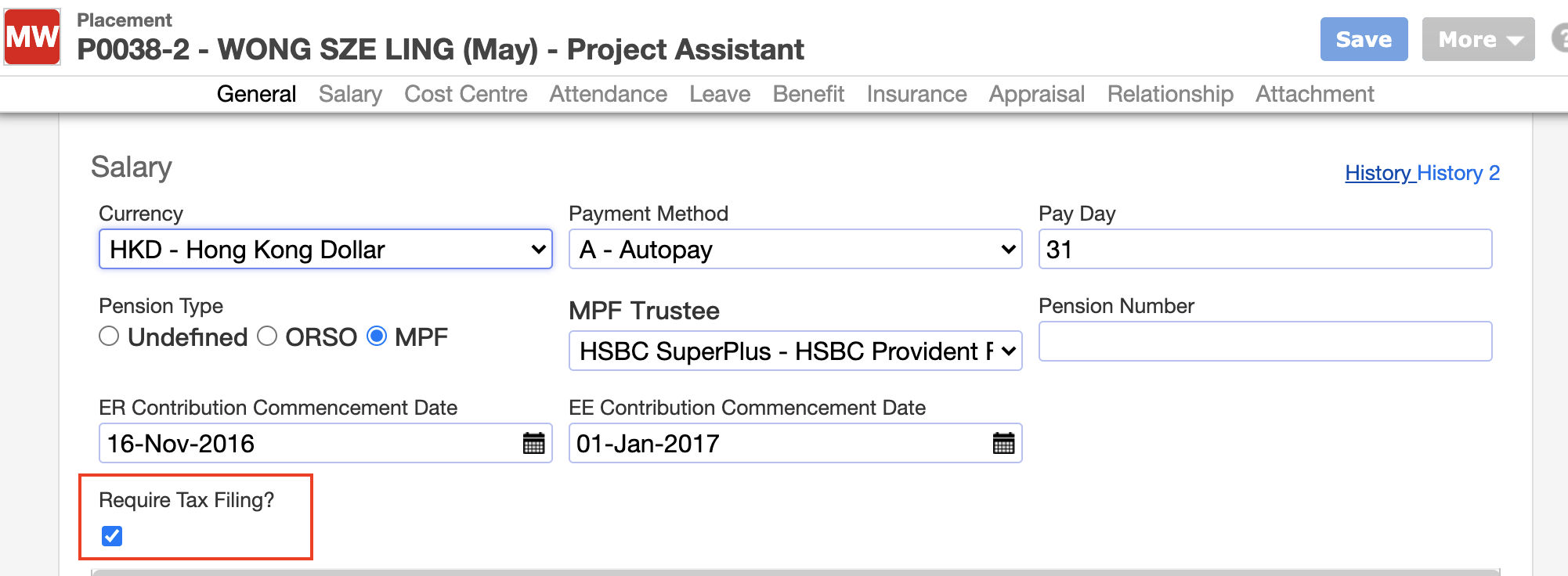

2. Input or Update the Staff Information

Backstage need to know the staff personal and job information before generating the rax form

- Go to Staff->Applicant to check the staff personal information, e.g HKID, Address, Marital Status

- Go to Staff->Placement to check the staff job information, e.g Join date, Position, and if "Require Tax Filing?" is enabled. Please disable "Require Tax Filing?" if the staff submits IR56M

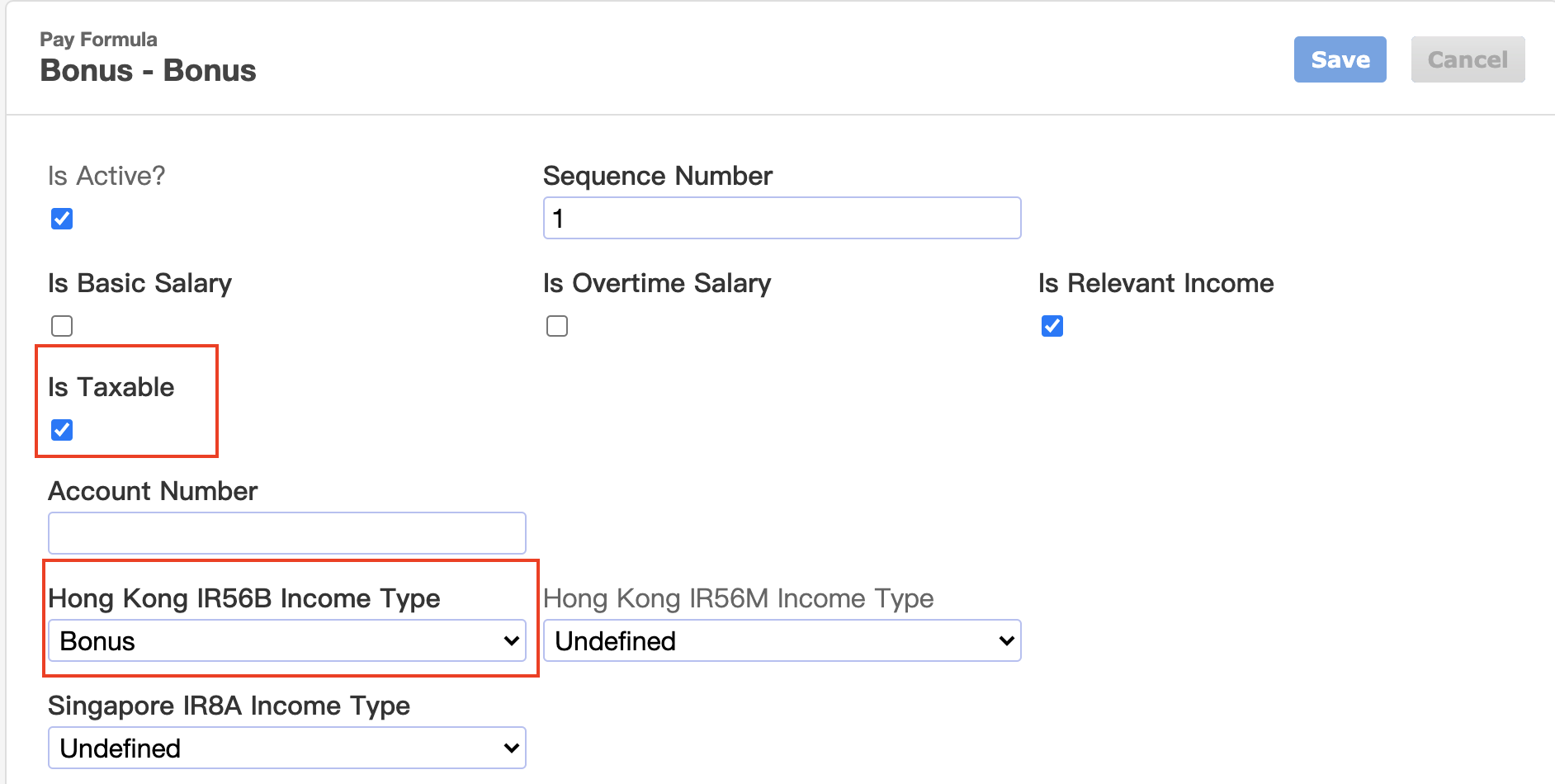

3. Setup/Review Payroll formula

Backstage need to know which tax category would the payroll amount fall into before generating the tax form

- Go to Payroll->Job Order Template and Review if the Pay types are correctly configured on whether it is taxable with proper tax category

4. Post the Payroll Batch

Backstage would only take the "Posted" payroll batch amount as the tax amount

- Go to Payroll->Payroll Batch and create, check and post the batch from last April to March

5. Generate IR56B/IR56F/IR56E/IR56G/IR56M

- Go to Taxable -> IR56B/IR56F/IR56E/IR56G/IR56M ->Add New (-> Add Placement) to generate the tax form you need

➡️ Prepare IR56B for submission

➡️ Prepare IR56F for submission

6. Generate the etax file/Print IR56B/IR56F/IR56E/IR56G/IR56M

When you finished the checking, you can generate the etax file or print the tax form and submit them to IRD

- Open the tax form/batch -> More -> Print IR56E/IR56F(2019)/IR56G/IR56M or Generate IR56B for eTax/IR56F XML and submit it to IRD

7. Deliver IR56B/IR56F/IR56E/IR56G/IR56M to your staffs

Once you submitted the form, you can deliver the tax form

- For IR56B, if you have ESS module, once your IR56B batch is posted, your staffs will see it available for download in ESS, or

- Open the tax form/batch -> More -> Print or Email the forms to staffs