Handle the "-ve" shown in tax form

23-Jun-2022 · Wing Au Yeung

Why the "-ve" is shown in the tax form?

Sometimes, you will see "-ve" after generating the tax form. You will find you cannot print the form or generate the XML file as any negative amount is not acceptable by IRD. The negative amount may be caused by e.g. NPL is counted in the Leave Pay tax category, or staff has taken advance annual leave and need to pay back the amount in Final Payment.

Payment in lieu of notice by employee is non-taxable.

(From IRD ird.gov.hk/eng/faq/cer.htm ➡️ Payment in lieu of notice" question 31)

Ways to solve the "-ve"

If it is possible to have a negative amount for the pay type, you need to merge the amount into other tax categories such as Salary. You can assign the pay types to different tax categories.

1. By System

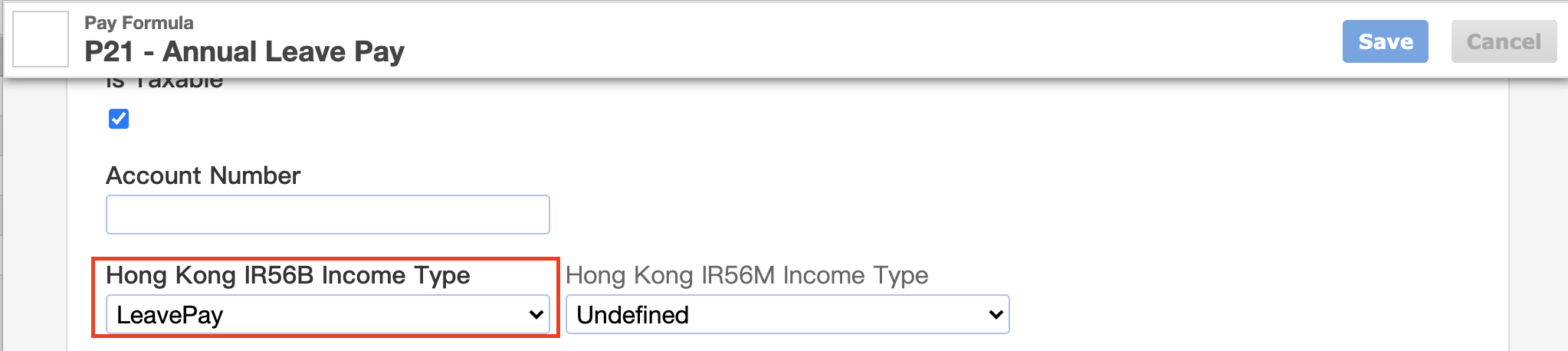

If you want that pay type amount to count into another tax category in long-term, you can update the system setting.

- Find out where is the negative amount comes from, i.e the pay type

- Go to Payroll->Job Order Template

- Change the tax category "Hong Kong IR56B Income Type", e.g "Salary"

- "Salary" is suggested as it is the tax category with most of the tax amount and should be more than the negative amount

- Recalculate the IR56F/IR56B and you see the amount being merged

- You can now print the tax form/ generate the XML file again

2. Manual Adjust

If you think it is a special case, you can adjust the amount manually.

- Click into the staff tax form

- Calculate the amount manually and merge it into another tax category, e.g Salary

- Delete the negative amount

In this page