【Hong Kong】Prepare IR56M for Submission

05-May-2023 · Wing Au Yeung

What do we need?

Let's make sure the following are done before we move onto IR56M reporting:

- Tax information of employer is updated (Master Data -> Organization)

- Employees' personal information is updated (Staff -> Applicant)

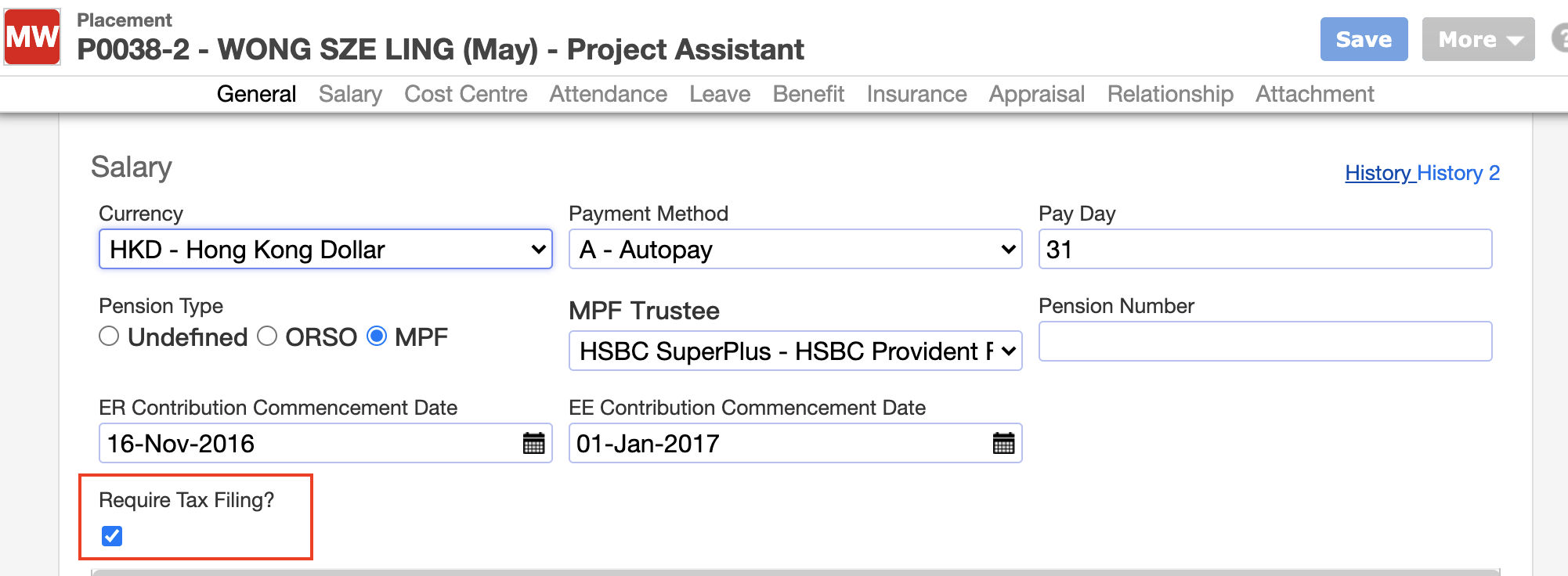

- Please make sure that "Require Tax Filing?" is Disable(Associate -> Placement -> Salary part)

- If the recipient is a company, please take a look at the following page and update the related information Prepare IR56M when recipient is a company

- Payrolls from last April to March are done and posted (Payroll --> Payroll Batch)

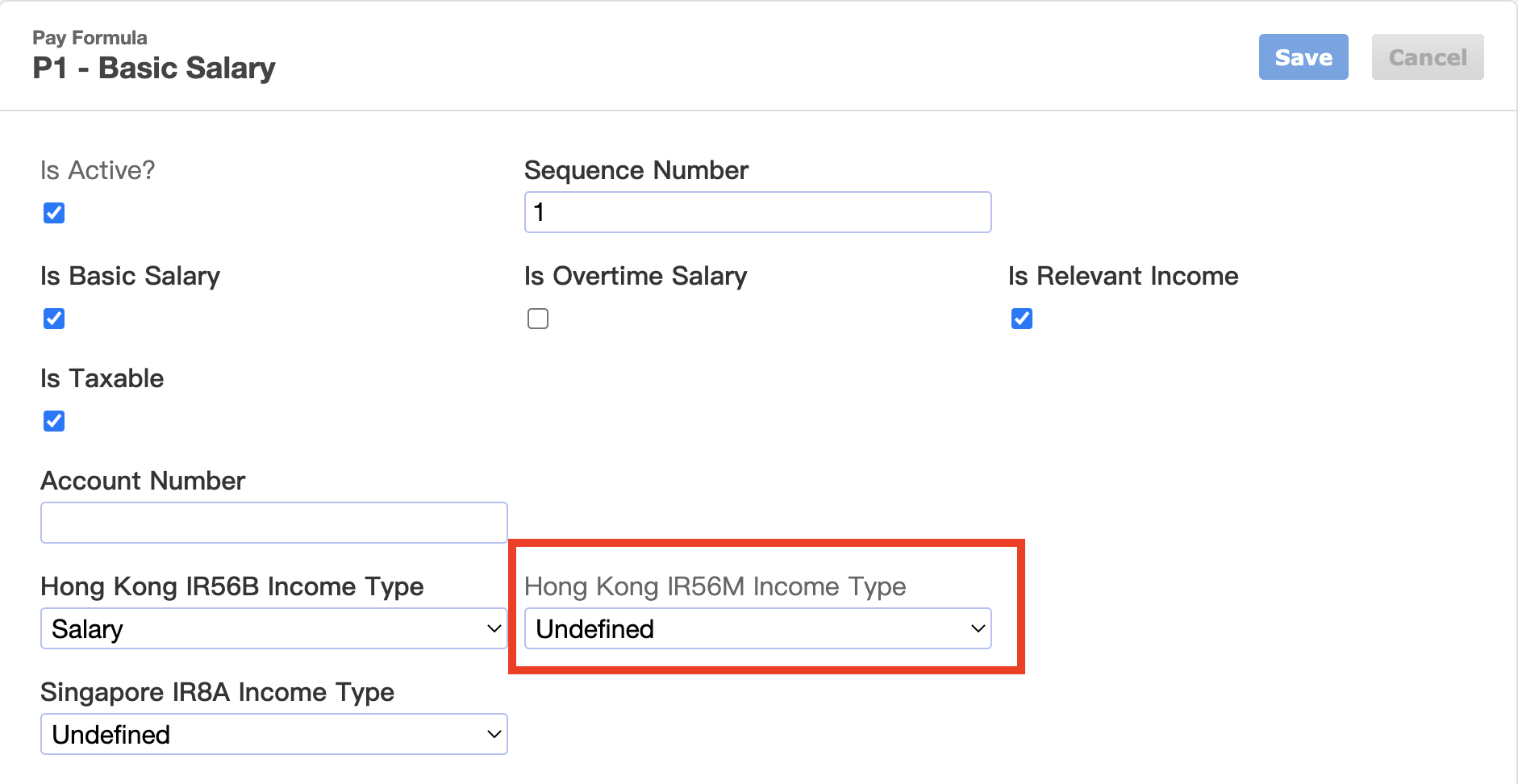

- Pay types are correctly configured on whether it is taxable with proper tax category (Master Data -> Job Order Template)

- Please make sure you have select the IR56M Income Type in Job Order Template

- Please make sure you have select the IR56M Income Type in Job Order Template

➡️ Details setting can take a look at Get Ready for using Taxation

Steps to preparing IR56M for submission

1. Preparing IR56M Batch

- Go to Taxation --> IR56M

- Click "Add New"

- Specify the company and tax period

- Confirm. You now have a blank IR56M batch

- Click "Add Placement"

- Pick who you are reporting tax. Just like payroll.

- Confirm. The staff are being added to the IR56M batch.

2. Reviewing IR56M

- Check and make changes to individual tax forms one by one, or

- Generate the reports to check the amount

- Go to Analytic->Taxation->

- Tax Details Report,

- Tax Summary Report, or

- Go to Analytic->Payroll->Payroll Details by Placement

- remember to choose the date of the tax period

➡️ Take a look at How to handle the "-ve" in tax form? if you find there "-ve" after generating the tax form.

- remember to choose the date of the tax period

- Go to Analytic->Taxation->

3. Submitting IR56M

- Go to More -> Generate IR56M for eTax

- Download and burn the XML file to CD/USB disc.

- More -> Generate Control List

- Print and Sign the control list

- Print and Sign the control list

- Together with the reply slip, submit your media and the checklist to IRD

4. Delivering IR56M to your staffs

- Click into the form->More -> Print IR56M/ Email IR56M to (staff individual email)

In this page