Difference between tax form type Original, Replacement, Supplementary and Additional

Sometimes, you want to amend the information previously reported on any form IR56B / IR56F. Other than the type Original, there are 3 kinds of tax form types: Replacement, Additional, and Supplementary for you to submit the Supplements / Amendments to IRD.

Difference between tax form type Original, Replacement, Supplementary and Additional

You can generate eTax file to submit IR56F/IR56B according to the type of tax form. You may refer to the below guidelines:

-

Original - If this is your first time submitting the placement's IR56B/ IR56F

-

Replacement - If you have already submitted the placement's IR56b/IR56F, but you find something missing or wrong, e.g missing/wrong tax amount or address and need to make modifications. So you submit the form again to replace the Original one.

-

Not Applicable in system Supplementary - If you have already submitted IR56B, and you find you have omitted to submit (some) placement's original IR56B for filing to IRD in the annual submission. As each company can only submit 1 time Original IR56B, you need to submit Supplementary form.

-

Not Applicable in system Additional - If you have already submitted the placement's IR56B/IR56F, but you find there is missing tax amount and you just want to submit the missing amount again.

Steps to prepare and submit the Replacement and Supplementary of IR56B/IR56F

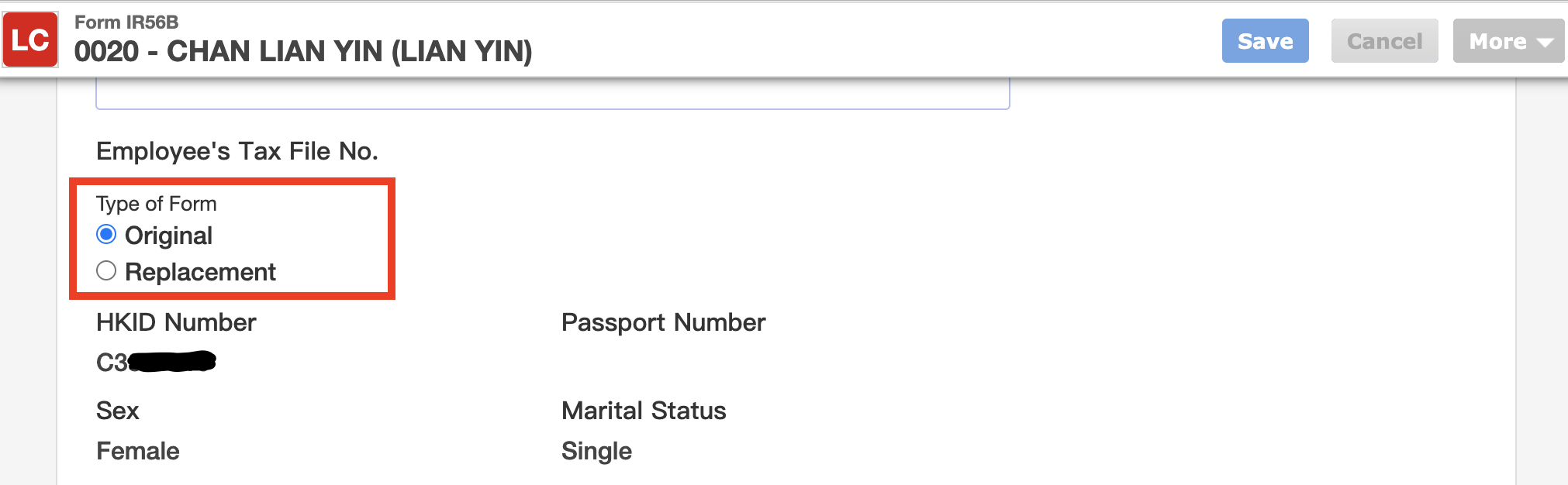

1. Preparing Replacement of IR56B/IR56F

- Generate the original IR56B or IR56F if you want to keep the copy

- Unpost the IR56B Batch if it is posted

- Amend the type of form to "Replacement"/ "Supplementary"

- Update information/amount in the staff's IR56B/IR56F

- Save

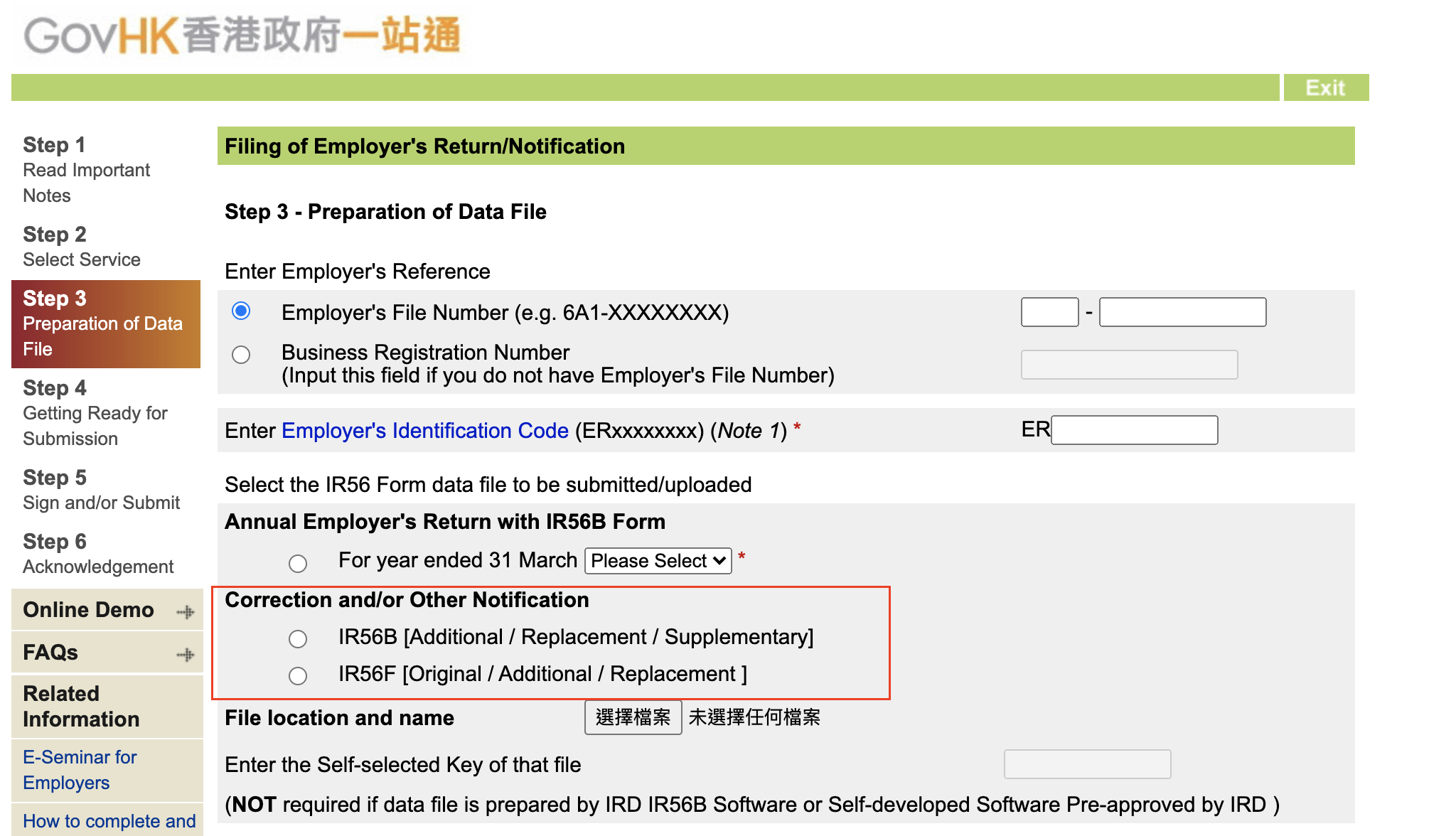

2. Submitting Replacement of IR56B/IR56F

- Open the Batch -> Go to More -> Generate IR56B for eTax"/ "Generate IR56f Xml

- Choose Replacement (the file would only contain the type of form you have chosen)

- Submit the generated file to the IRD via etax

3. Delivering IR56B or IR56F to your staff

- If you have ESS module, once your IR56B batch is posted, your staff will see it available for download in ESS.

- Alternatively, you can Print or Email the forms to staff