Make first MPF contribution to staff

21-Oct-2022 · Felix Fung

Why make MPF first contribution to staff?

New staff is joining your company and you have to prepare his first contribution to MPF trustee.

How to make first MPF contribution?

The process spans from the staff join date until the first MPF statement is submitted, as the final result depends on how payroll is calculated from day one.

1. Check that the staff is ready for MPF

1.1 Applicant Profile:

- Date of Birth is correctly entered. MPF calculation is triggered only for staffs between age of 18 and 65.

- Working Visa is correctly entered if any.

1.2 Placement Profile:

- Start date is correctly entered

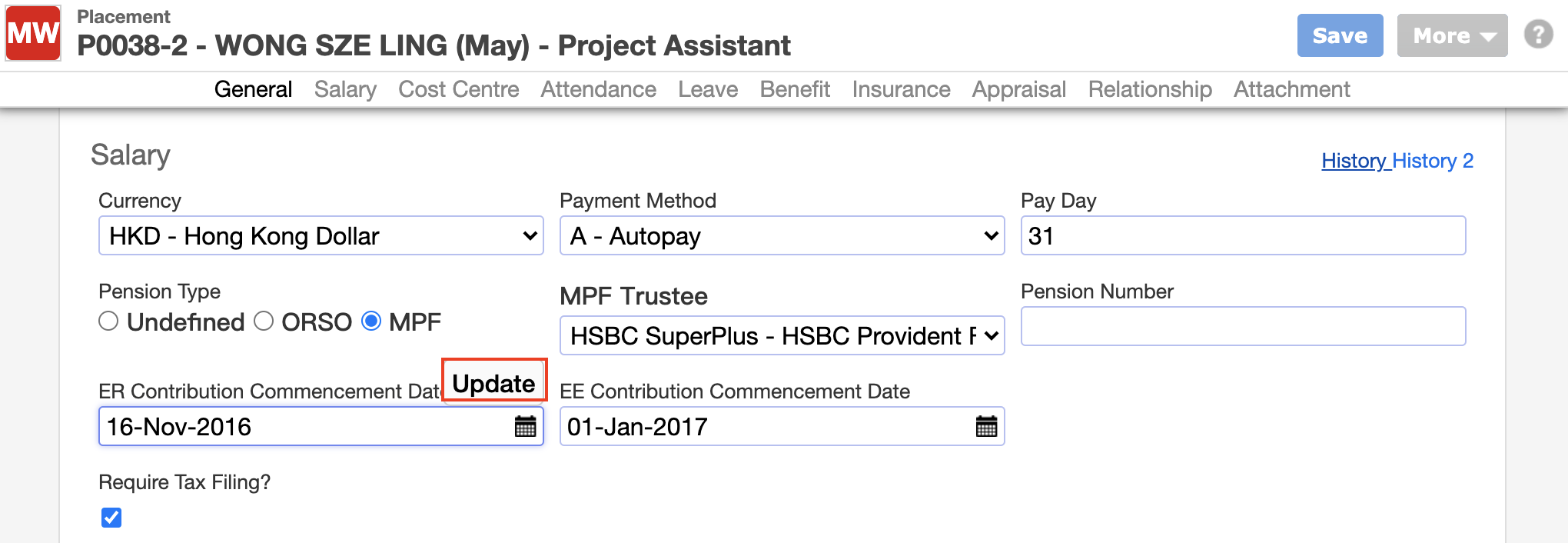

- Pension Type is configured as MPF

- MPF Trustee is selected

- Employer Contribution Commencement Date and Employee Contribution Commencement Date are correctly entered

- System will calculate the correct dates according to the staff start date. Unless you have special reason, please use the default dates calculated by the system, of which:

- Employer Contribution Commencement Date: same as the join date

- Employee Contribution Commencement Date: the start date of the next month of which the 61st day is

- System will calculate the correct dates according to the staff start date. Unless you have special reason, please use the default dates calculated by the system, of which:

Reminder

If you have updated the staff Start Date after the placement is created, please "Update" the Contribution Commencement date also as below picture. The date would be updated according to the new start date.

2. Prepare payroll until First Contribution

- Check the payroll amount and MPF retention amount until the First Contribution month

| Field | Description |

|---|---|

| On or before First Contribution | The contribution will be stored at "Retention" pay type. This is a non-cash pay type and therefore does not affect the pay amount received by the staff. But its amount will be retrieved during the first contribution as well as in MPF statement |

| On First Contribution | Previous month(s) and Current month"Retention" amount is added up and put at ordinary MPF pay types. This is the total amount you need to pay for the staff first MPF contribution. Please note that retention for the current month is also involved. |

| After First Contribution | All MPF amounts will be calculated at ordinary MPF pay types. |

3. Generate the MPF statement

- Check the "New Join" excel sheet/section in your MPF statement, which is showing the total "Retention" amount from current and previous payroll.

What's Next?

- Submit the MPF statement to MPF Trustee

In this page