Configure Pay Type for Average Daily Wages (ADW) calculation

其他語言版本 English

Why configure Pay Type for Average Daily Wages(ADW) calculation?

According to Employment Ordinance, when calculating the minimum salary amount for specific day or day-off, employer must refer to the average amount of the past 12 months and include those "wages" as defined in Employment Ordinance.

However, some of the wages need to be excluded from the calculation. To avoid understating the average wage, the day where no salary is paid, or only partial amount is paid, should be excluded from the calculation.

So, you would use ADW in your payroll calculation and therefore you are required to configure pay type correctly.

How to create configure Pay Type?

1. Create the Pay Type

Skip if the pay type has been created

- Go to Payroll -> Pay Type -> Add New to create the Pay Type

- Details can take a look at the page Pay Type

2. Specify if the Number of Days and Pay Amount are excluded from the ADW calculation

- Go to Payroll -> Job Order Template -> Locate the Job Order Template you use

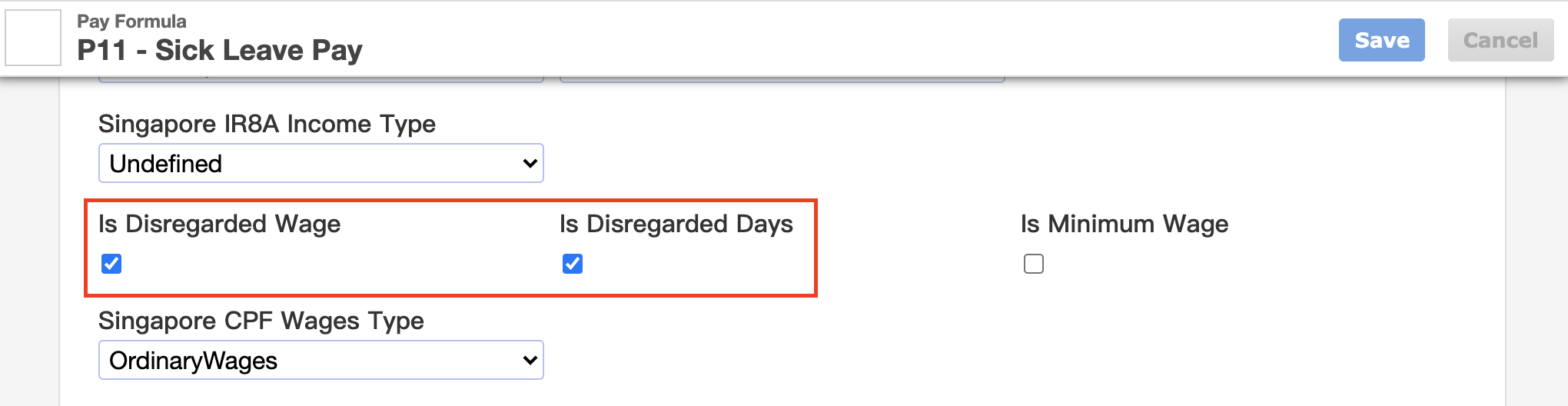

- Click on each Pay Type -> Define and update the following settings

- Is Disregarded Wages? : Enabled, pay amount is excluded from the amount in ADW calculation

- Is Disregarded Days? : Enabled, number of days is excluded from the days in ADW calculation

How to decide if the Number of Days and Pay Amount of the Pay Type is included or excluded from the calculation?

12-Month Average Daily Wages =

(12-Month Gross Salary - Disregarded Wages) / (Number of Days in the 12-month Period- Disregarded Days)

Gross Salary and Number of Days in Period are already calculated by Backstage. So you will need to specify what are the disregarded wages and disregarded days.

Details you can see the following page: Average Wage (713)

How to check the calculation in Backstage?

For the details of the calculation, you can check it by going to

- Payroll Batch or Click on Staff Payroll -> More -> Print Average Daily Schedule to check that month's ADW calculation, OR

- Analytic -> Payroll -> Print Average Daily Schedule to check the staff ADW calculations with the month you want