Staff has No or Wrong MPF contribution

21-Oct-2022 · Wing Au Yeung

其他語言版本 English

其他語言版本 English

Why staff has No or Wrong MPF contribution?

Sometimes, you may find the EE and ER MPF contribution amounts are "wrong" or become 0 and you cannot see the staff in the MPF Remittance report. You need to think of the following situations:

- The staff is below 18 or over 65

- The total payroll amount is less than HKD7,100

- The staff employment period is within the MPF contribution holiday

- The pay type amount should not be included in the relevant income

For more details of the MPF calculation, you can take a look at the following pages from MPFA

1. MPF System Mandatory Contributions

2. MPF Contribution Guideline

How to handle the staff who have No or Wrong MPF contribution?

1. The staff is below 18 or over 65

For staff who are below 18 or over 65, both ER and EE no need to make the contribution.

- If staff reaches 18 in the mid-month, the EE and ER MPF contribution would be calculated from the staff Birthday to the last day of the month

- If staff reaches 65 in the mid-month, the EE and ER MPF contribution would be calculated from the 1st day of the month to the day before the staff's birthday.

- E.g staff reach 65 on 11 Apr 2021 with salary HKD15,000/monthly, then only 5% of the salary amount from 1 Jan to 10 Apr need to make the contribution, i.e 15000/30*10*5%=HKD250. After 12 Apr 2021, both ER and EE no need to make MPF contributions anymore.

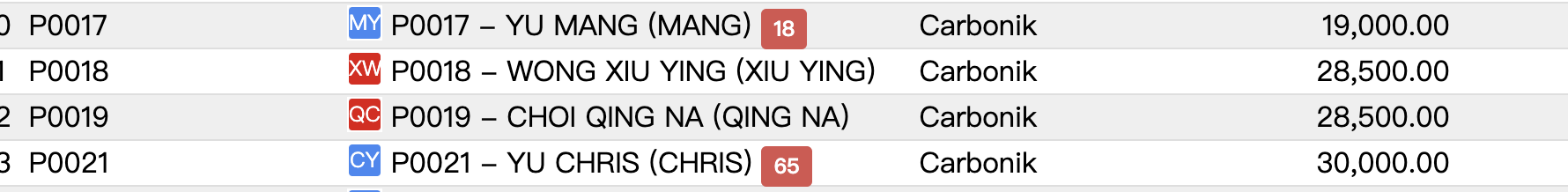

- System would have a reminder, 18 and 65 beside the name of the staff when you generate their payroll

2. The Total Payroll Amount is less than HKD 7,100

- For staff Monthly Salary less than HKD 7,100, EE no need to make MPF contribution.

3. The staff Employment Period is within the MPF Contribution Holiday

- Staff have 30 days Contribution Holiday. Backstage would calculate the staff 1st ER and EE Contribution Commencement Date automatically according to the staff Join Date.

- If you update the join date after the Placement is created, please "Update" the ER and EE Commencement Date also

- Please go to the staff Applicant profile to update the Birth Date and then update the ER and EE Contribution Commencement Date if you see the ER and EE Contribution Commencement Date is in year 203X as you may wrongly input the birth year.

- If you update the join date after the Placement is created, please "Update" the ER and EE Commencement Date also

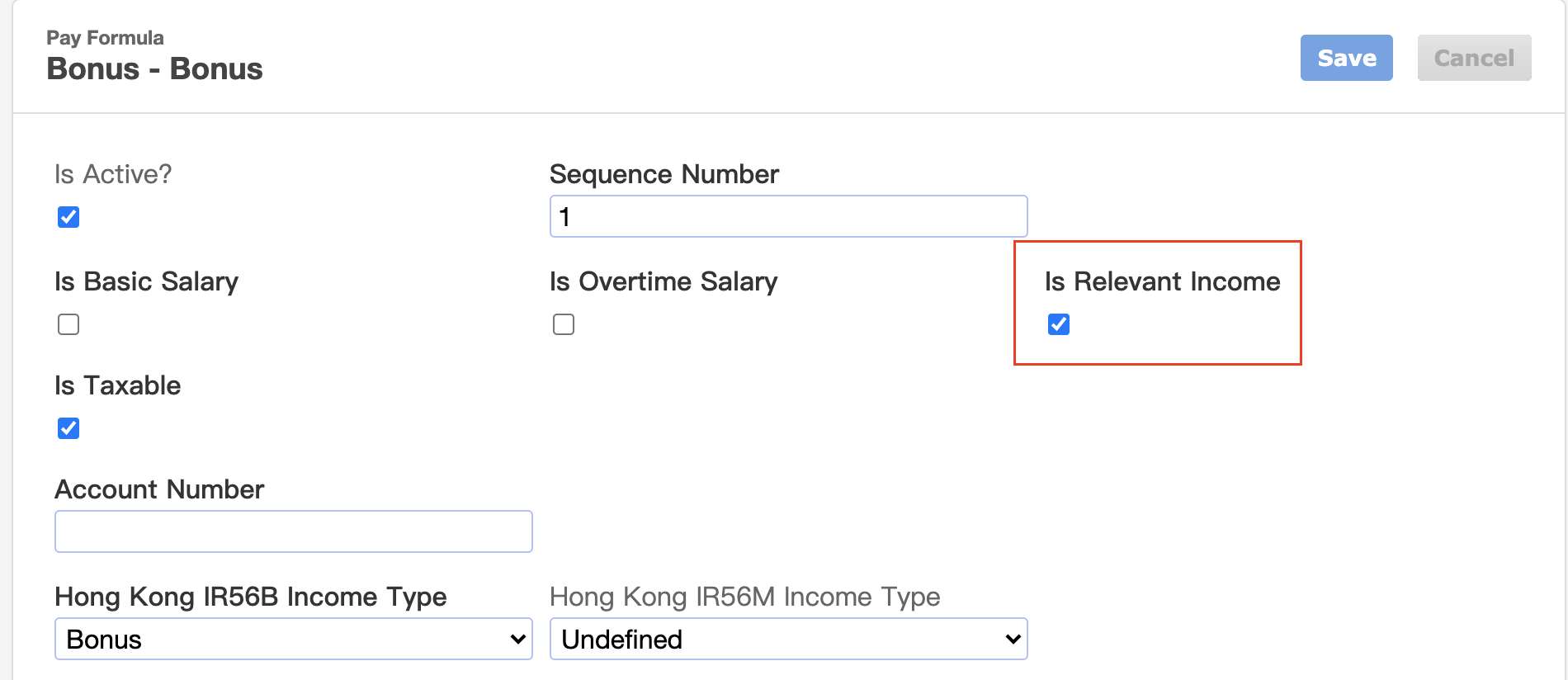

4. The Pay Type Amount should be / should not be included in the Relavant Income

Some of the pay amounts is excluded from the Relevant Income, e.g Severance Payments or Long Service Payments

- Go to Payroll -> Job order Template -> Choose the template -> Find the pay type

- Enable / Disable "Is Relevant Income".

- Recalculate the payroll

本頁內容