Configure "Place of Residence Provided" section in tax forms

23-Jun-2022 · Felix Fung

其他語言版本 English

其他語言版本 English

What is "Place of Residence Provided" for?

You have staffs of which the company is providing placement of residence and you will have to report this when preparing Hong Kong tax forms IR56B, IR56F or IR56G to the IRD.

Steps to prepare the records for "Place of Residence Provided" section

1. Configure the Address

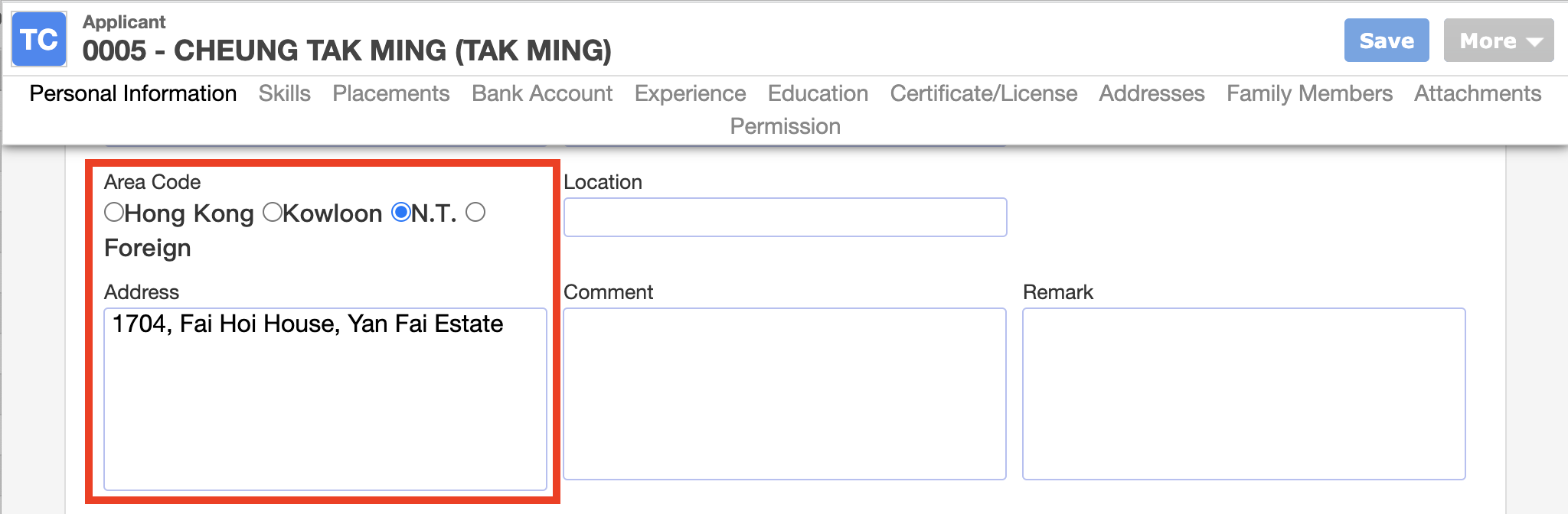

- Go to Staff-->Applicant, locate the Applicant profile.

- Input the address in the Address section

- Address inputted in the Personal Information part would be shown in "Residential Address" of the tax form only

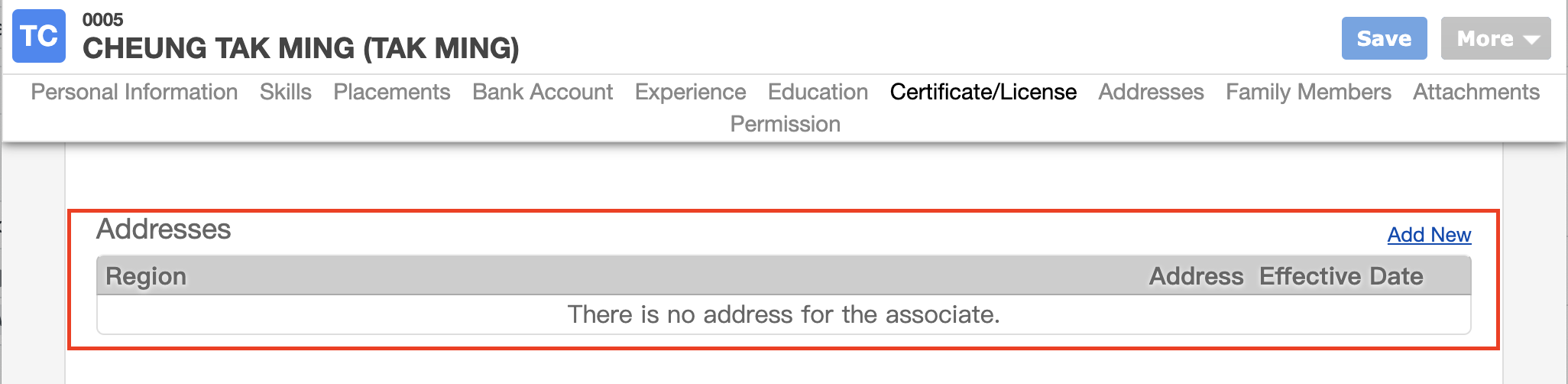

- Please input the address again in the Address section even it is the same as address in the Personal Information

- When generating tax form, the system will check the corresponding effective date of these address records, and insert the first 2 valid within the tax year to the tax form. If you have more than 2 residences provided, please submit a separate tax form

- Address inputted in the Personal Information part would be shown in "Residential Address" of the tax form only

2. Configure the tax amount

- Go to Payroll-->Job Order Template, locate the related Job Order Template

- Check the relevant pay types(e.g Housing Allowance), and make sure they are configured to either:

- Rent to Landlord by Employer (1 or 2)

- Rent to Landlord by Employee (1 or 2)

- According to their nature, the amount for "Rent to Landlord by Employee" will be copied to "Rent Refunded by Employer" by Backstage so you only need one pay type to insert to both tax categories.

- Rent Refunded by Employer (1 or 2)

- Rent to Employer by Employee (1 or 2)

➡️ Repeat 1 & 2 for all staff and job orders

🎊 The system will take your configuration and fill in the tax forms as directed 🎊

Reference

- Please refer to the IRD document https://www.ird.gov.hk/eng/pdf/pam44e.pdf for guidelines of preparing this section.

本頁內容