【Hong Kong】Prepare IR56M when recipient is a company

21-Oct-2022 · Felix Fung

其他語言版本 English

其他語言版本 English

Why Prepare IR56M when the recipient is a company?

You have several contractors whose payment has to be reported in IR56M. You would like to be reported as company but not individual person.

What you need?

- Company name and the Business Registration number of these contractors

How to prepare Contractors for IR56M submission?

1. Disable "Require Tax Filing?"

- Go to Staff -> Placement -> Salary section -> Disable "Require Tax Filing?" if the staff submits IR56M

2. Create Certificate Type for Business Registration

- Go to Master Data -> Certificate Type -> Add New

- Code = BR, Name = Business Registration

- Save

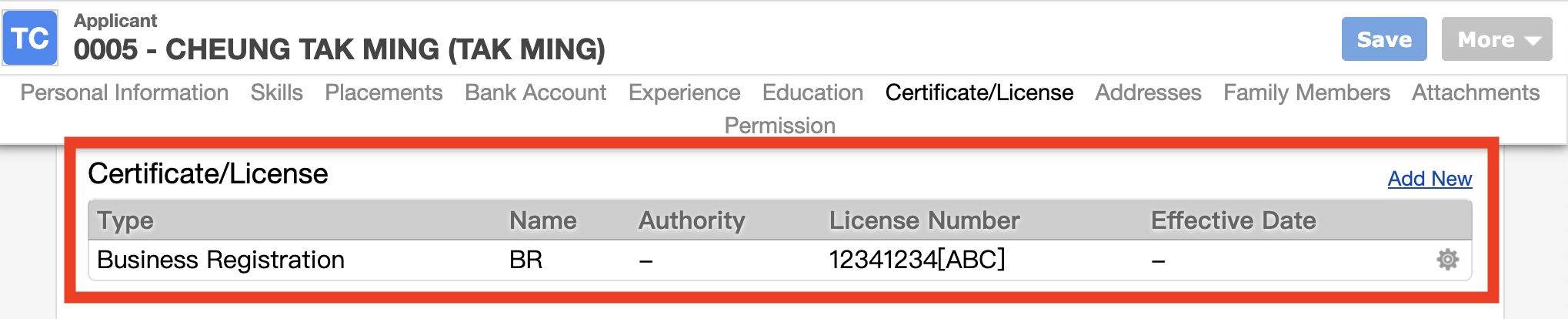

3. Add the company as Certificate in Applicant

- Go to Staff -> Applicant -> open the staff profile

- Add a new certificate record to Certificate section

- Certificate Type = Business Registration

- Certificate Name = BR

- License Number = Business Registration Number[Company Name]

- e.g. 12341234[ABC Limited]

- e.g. 12341234[ABC Limited]

- Authority can be "-"

- Repeat these steps for other staff as needed

- You can do it through importing if you want to add a batch of records in once

- Please delete the existing records in the template file before importing the file. Otherwise, the records would be duplicated

- When generating IR56M, if the system would detect the existence of such Certificate record, the company name and Business Registration number will be used.

What's Next?

- Generate the IR56M to check the setting

- Submit IR56M to IRD

- Print/Email the IR56M to staff

本頁內容